News

2025 Q2: Updates to the List of PDBs and DFIs and New Data Release

In the second quarter of 2025, the Public Development Banks (PDBs) and Development Financing Institutions (DFIs) database team continued to update the global list of PDBs and DFIs. This update added 7 new institutions, expanding the database to include a total of 544[1] PDBs and DFIs worldwide.

In addition, the database team released the remaining 6 financial indicators for 277 PDBs and DFIs that were not included in the data sample of the fifth database flagship report. This release aims to provide a more comprehensive view of the financial profiles of global PDBs and DFIs over the six-year period from 2018 to 2023.

A. List Updates: 7 Newly Added DFIs

To ensure a comprehensive and latest global list of PDBs and DFIs, the database team regularly engages in discussions and reviews of potential institutions worldwide. In this quarter, we noticed and identified 16 potential institutions. After a detailed examination of their background information, such as the legal status, mandates, and financial structures, we confirmed 7 of them as PDBs and DFIs.

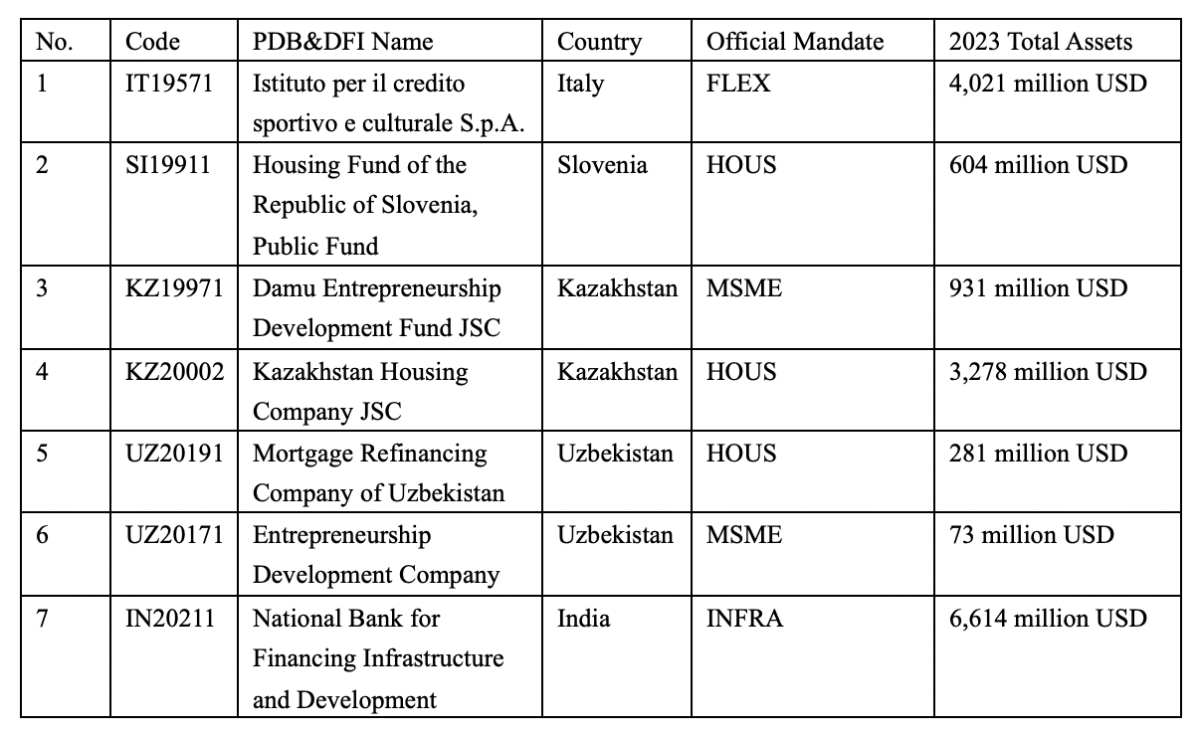

The newly added institutions are Institute for Sports and Cultural Credit S.p.A., Housing Fund of the Republic of Slovenia, Public Fund, Damu Entrepreneurship Development Fund JSC, Kazakhstan Housing Company JSC, Mortgage Refinancing Company of Uzbekistan, Entrepreneurship Development Company, National Bank for Financing Infrastructure and Development.

Basic information about these institutions is provided below:

(Please refer to the official PDB and DFI database for more detail.)

To further verify the potential inclusions and ensure the reliability of the global PDBs and DFIs list, we implemented three rounds of quality control. In the first round of quality control, our research specialists conducted thorough investigations and documented detailed supporting evidence by strictly applying operational indicators of the following five qualification criteria:

1) Being a standalone entity.

2) Providing fund-reflow-seeking financial instruments as the main products and services.

3) Funding sources going beyond periodic budgetary transfers.

4) Having a proactive public policy orientation.

5) Government steering of corporate strategies.

In the second round of quality control, a peer senior researcher rigorously reviewed the supporting evidence to ensure the accuracy of the identification for each included institution. In the final round of quality control, (co-) principal investigators from the Public Development Finance Research Program at Peking University (PKU), the French Development Agency (Agence Française de Développement, AFD), and the Foundation for Studies and Research on International Development (Fondation pour les Études et Recherches sur le Développement International, FERDI) provided the ultimate verification of the updates on the PDBs and DFIs database.

B. Data Release: 6 Financial Indicators of 277 PDBs and DFIs for FY18-23

In the last quarter, with the release of the fifth database flagship report entitled “Exploring the Financial Profiles of Public Development Banks: An Umbrella Paper”, our team published 6 financial indicators for 259 national and subnational development banks with at least three-year data available during the period of 2018-2023 included in the report’s data sample, as well as the total assets data for 434 institutions in the PDBs and DFIs database with at least one-year data available for the fiscal years from 2018 to 2023.

In this quarter, to further enhance the comparability and completeness of the database, our team decided to release the remaining 6 financial indicators for 277 PDBs and DFIs that were not part of the previous report’s sample. These indicators - total equity, total liabilities, net income, profit before tax, net interest income, and number of employees - also cover the six-year period from 2018 to 2023.

Our data collection method combines natural language processing and manual data collection, with rigorous quality control. To collect publicly available financial data comprehensively and accurately, we have conducted three rounds of quality control, including a cross-checking, a double-checking and final verification by a team of researchers from the PKU, AFD, and FERDI.

Forthcoming Steps:

Moving forward, the database team will continue to proactively and rigorously update the global list of PDBs and DFIs, including their basic information, key financial indicators, and thematically-focused data modules. We hope that our ongoing effort will contribute to advancing original research in the field of public development finance and help unlock the full potential of PDBs and DFIs.

To learn more, please visit our data visualization website (http://www.dfidatabase.pku.edu.cn/) to register and download the database for free. For using the information from the database, please cite: Xu, Jiajun, Régis Marodon, Xinshun Ru, Xiaomeng Ren, and Xinyue Wu. 2021. “What are Public Development Banks and Development Financing Institutions? ——Qualification Criteria, Stylized Facts and Development Trends.” China Economic Quarterly International, volume 1, issue 4: 271-294; database DOI: https://doi.org/10.18170/DVN/VLG6SN.

We welcome feedback from academia, policymakers, practitioners from PDBs and DFIs, and other stakeholders to provide constructive suggestions and fill gaps in the database. Please contact us at nsedfi@nsd.pku.edu.cn.

[1] Starting from this quarter, to provide a nuanced picture on the financial profile of individual institutions at the World Bank Group, its parent institution – the International Bank for Reconstruction and Development (IBRD) – and its concessional window – the International Development Association (IDA) – are displayed as two standalone entities in the database. The reason for merging the two together before is that they have the same management team even though IDA has an independent legal status.